Although most people deal with compound interest on a regular basis, they rarely think about it in terms of mathematics. Yet compound interest is rooted in the interest formula. Why is this important? You can save significant money and make better life choices if you have a better understanding of how compound interest works.

The Basics of Compound Interest

Let’s begin by looking at the basics of compound interest and the interest formula with an example.

Josh deposits $1000 in the bank. In return for being able to use his money, the bank offers him five percent interest on his money. The bank says the interest will be compounded each year on the same date the initial $1000 was made.

Josh now knows that at the end of the first 12 months, he will get his $1000 back, as well as five percent of the $1000. In other words, $1000 + ($1000 x 0.05). This comes to $1050.

However, this is the tip of the iceberg. Although this simplistic formula works in this case, it does not take into consideration other factors and does not work when new factors come into the picture. In other words, we need a better, more inclusive formula. Fortunately, we have one!

The Complete Compound Interest Formula

What if Josh keeps his money in the bank for several years? How could he figure out his earnings at five percent interest compounded over 10 years? As you might guess, a special interest formula can be used.

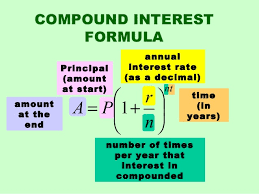

This formula is A = P(1 + r/n)^nt. The letters in the formula all revert to single pieces of information:

The letters in the formula all revert to single pieces of information:

●A is the final amount earned

●P is the initial amount

●r is the interest rate in decimal format

●n is the number of times per year the interest is calculated

●t is the number of years the interest is calculated

Using the formula above to find out how much Josh would earn after 10 years, we would need to determine A = $1000 (1 + .05/1)^(1)(10). The answer comes to $1,628.89.

If that process doesn’t make sense, I would recommend checking out our comprehensive guide to college algebra topics. This is the same number we would get if we figured out year by year the compound interest by hand; that would be long and tedious, and we would be more apt to make errors. With the formula, we can figure out compound interest much faster and easier!

What Happens If Compound Interest Is Measured More Than Once a Year?

Obviously, Josh earned money after 10 years. What if he had chosen a bank that offered the same percent rate compounded four times a year instead of once? In that case, the formula for 10 years of money growth would change to:

A = $1000 (1 + .05/4)^(4)(10)

This new problem’s answer is $1,643.62.

To get this and other interest formulas explained, we recommend getting equations homework help.

Look at the difference between the two answers. When interest is compounded one time per year, Josh earns less than if it is compounded four times per year. Which bank makes more sense for Josh if he wants to earn more money? The second bank, by almost $15.

Obviously, the more times per year the interest is compounded, the higher the end earn rate.

How Compound Interest Is Useful to You

Over your life, you will be faced with many opportunities to consider compound interest, such as when you place money into a certificate of deposit (CD) to earn money or take out a compound interest loan for a vehicle purchase. Always revert to the compound interest formula to help you choose wisely, whether you are spending or saving. It doesn’t take long to apply the interest formula.

Over your life, you will be faced with many opportunities to consider compound interest, such as when you place money into a certificate of deposit (CD) to earn money or take out a compound interest loan for a vehicle purchase. Always revert to the compound interest formula to help you choose wisely, whether you are spending or saving. It doesn’t take long to apply the interest formula.